The Automotive Oscillator Market Is Being Disrupted

A Silent Revolution: Timing Chips Reshape the Automotive Landscape

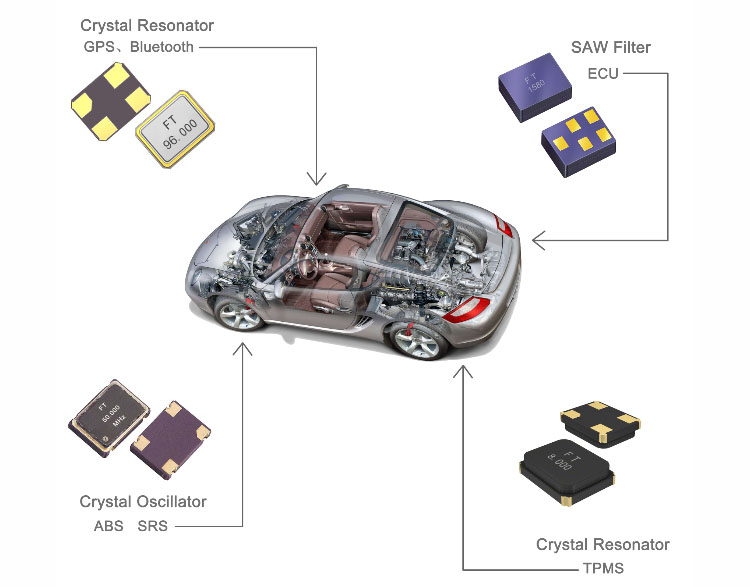

In 2025, SiTime catapulted into the spotlight thanks to its widespread adoption in Apple devices, bringing MEMS-based oscillators into the mainstream. Precision timing components have quietly become the backbone of modern electronics—essential in artificial intelligence, data centers, network infrastructure, consumer mobility, and the ever-evolving Internet of Things (IoT). According to SiTime’s projections, the timing market’s potential exceeds $10 billion. As these technologies expand into automotive electronics, the demand for automotive-grade oscillators is surging. A single vehicle today may require dozens of oscillators, each critical to stable operation.

Evolving Timing Demands in Automotive Systems

Historically, electronic control units (ECUs) relied on slower communication protocols like CAN and LIN, which operated under modest timing requirements. One oscillator—or even a low-precision RC oscillator—was sufficient to maintain basic synchronization. But the industry has moved forward. The rise of domain and zonal architectures has ushered in high-speed data buses like Ethernet, FPD-Link, and GMSL.

These interfaces demand ultra-low-jitter clocks to function correctly. Excessive jitter can increase bit error rates (BER), disrupting real-time data transmission. With complex ECUs, particularly those used in advanced driver assistance systems (ADAS), precision becomes even more critical. Many such systems use multiple processors—main SoCs and vision co-processors—connected via PCIe. For example, PCIe 4.0 requires a 100 MHz differential clock with jitter below 500 fs (in the 12 kHz to 20 MHz range). As a result, demand for high-performance timing devices in vehicles has become more urgent and widespread.

Understanding Quartz Crystal Oscillators

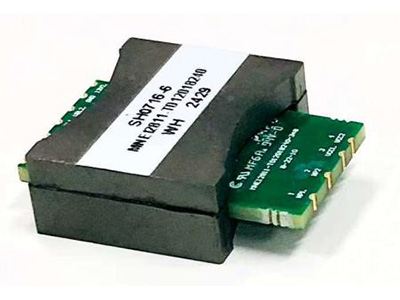

A crystal oscillator is an electronic oscillator circuit that leverages the inverse piezoelectric effect. When an electric field is applied to piezoelectric materials like quartz, they deform mechanically and resonate at a precise frequency. This resonance generates a highly stable oscillating signal.

Quartz oscillators boast high frequency stability, superior quality factors, compact size, and low cost. These characteristics give them a distinct edge over LC circuits, ceramic resonators, and tuning forks. Quartz crystals are sliced with precise orientation angles, silver-coated on both faces to create electrodes, and housed in metal, ceramic, or plastic packages.

There are two primary types of crystal oscillators:

Passive Crystals: Require an external oscillator circuit to drive resonance and do not draw power on their own. While cost-effective, they offer limited precision.

Active Oscillators: Contain internal amplification circuitry and require power to function. They offer enhanced accuracy but come with higher costs.

Despite their ubiquity, traditional crystal oscillators face challenges in advanced automotive applications where extreme temperatures, vibrations, and fast data rates become the norm.

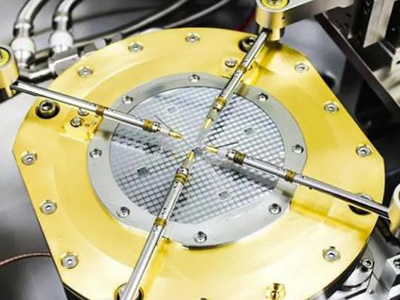

The Emergence of MEMS Oscillators

MEMS (Micro-Electro-Mechanical Systems) oscillators are disrupting this space with a fundamentally different design approach. They use micromachined silicon resonators activated by piezoelectric or electrostatic drive mechanisms to create stable frequencies. SiTime’s MEMS oscillators, crafted using proprietary processes, are built from silicon, offering superior thermal stability, shock resistance, and compatibility with CMOS fabrication lines.

MEMS oscillators excel in automotive environments due to their reliability under thermal gradients, resistance to vibration, and miniaturization. Their sealed packaging prevents contamination, and their manufacturability offers consistency and scalability, often lacking in traditional quartz solutions. MEMS are inherently less sensitive to mechanical stress, making them ideal for applications subject to constant movement or impact.

For automotive-grade use, they meet or exceed standards like AEC-Q100, offer wide operating temperature ranges, tight frequency tolerances, and ultra-low EMI. MEMS solutions are particularly compelling in ADAS platforms, where high reliability and performance are mission-critical.

SiTime’s Role in ADAS Innovation

SiTime’s MEMS oscillators outperform traditional quartz solutions in key metrics such as vibration noise immunity and injection noise resistance. These advantages make them ideally suited for ADAS environments, where timing integrity is paramount and failure is not an option.

As vehicles transition toward software-defined architectures and sensor fusion, the need for synchronized timing across disparate systems only grows. MEMS oscillators offer both the mechanical resilience and the electronic precision required to meet these new demands.

BAW Oscillators: The Rise of Bulk Acoustic Wave Technology

Bulk Acoustic Wave (BAW) oscillators are another rising force in the precision timing market. Utilizing acoustic resonance within a solid piezoelectric material, BAW technology can achieve GHz-range frequencies with high Q factors and exceptional jitter control. This makes BAW especially suitable for integration into mixed-signal or RF-intensive environments.

Texas Instruments (TI) is extending BAW’s reach from telecom and consumer electronics into automotive applications. Their newly launched AEC-Q100-qualified BAW oscillators—including the CDC6C-Q1, LMK3H0102-Q1, and LMK3C0105-Q1—are packed with advanced features. These include integrated temperature sensors, ultra-low-jitter frequency dividers, and multi-LDO power management for stable operation under automotive conditions.

Advantages of BAW Oscillators in Automotive Applications

TI’s BAW oscillators present several distinct advantages over quartz:

Programmable Frequencies: Unlike quartz, which requires mechanical tuning, BAW supports on-chip frequency programming via one-time programmable memory (OTP), allowing wide-ranging configurability.

Superior Thermal Stability: Maintains ±10 ppm across the full temperature range—far tighter than typical quartz variations.

Low Vibration Sensitivity: With typical performance of 1 ppb/g, BAW passes stringent MIL-STD-883F testing, outperforming quartz’s often inadequate +10 ppb/g.

Exceptional Shock Resistance: While quartz often fails beyond 2,000g, BAW units can endure 1,500g with less than 0.5 ppm drift.

Optimized EMI Performance: Options such as slew rate control and spread-spectrum modulation help BAW oscillators pass CISPR-25 Class 5 EMI tests—essential for vehicle electronics.

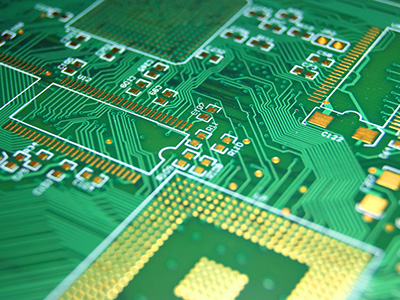

Compact PCB Footprint: BAW oscillators come in ultra-small packages (as small as 1.6mm x 1.2mm), enabling dense layouts in space-constrained automotive PCBs. Active oscillators require minimal external components, reducing BOM complexity and layout sensitivity.

In advanced automotive clock trees, particularly within ADAS and IVI systems, these advantages are crucial for maintaining signal integrity across longer interconnect distances and under harsh environmental conditions.

Conclusion: A New Era for Automotive Timing

From smartphones to servers, and now to vehicles, oscillators built using semiconductor technology are rapidly displacing traditional quartz. MEMS and BAW innovations are proving not only more reliable but also more scalable, programmable, and robust—qualities increasingly essential in automotive design.

As automotive electronics shift toward electrification, autonomy, and connected ecosystems, the timing component is no longer a mere accessory. It’s a cornerstone. MEMS and BAW oscillators are leading this transformation, signaling a disruptive yet inevitable future for the automotive oscillator market.

Shenzhen Gaorunxin Technology Co., Ltd